-

Multi-Chart Management in Fintechee WEB Trader for Algorithmic Trading

Importance of Monitoring Multiple Charts in Real-TimeIn Forex and financial markets, traders often need to track multiple instruments simultaneously. Relying on a single chart can limit perspective and lead to missed opportunities. Real-time monitoring of multiple charts is essential for algorithmic trading, allowing traders to compare trends, identify patterns, and make informed decisions quickly. Without

-

Why Spread Betting Appeals to CFD Traders in Certain Markets

Financial spread betting has grown in popularity among traders who are already familiar with CFDs and other leveraged trading products. While it shares many characteristics with CFD trading, spread betting offers unique advantages that make it particularly attractive in certain markets. Brokers using platforms like Fintechee can capitalize on these opportunities to offer differentiated services.

-

Integration of Semi-Decentralized Exchange in Fintechee White Label

As digital assets become an essential part of modern trading ecosystems, brokers and financial institutions require flexible and secure infrastructure to support new asset classes. Fintechee addresses this demand by offering its semi-decentralized exchange as a white-label plugin, allowing clients to integrate advanced digital asset transfer capabilities into their existing trading platforms with minimal effort.

-

Integrating Third-Party Licenses and Payment Gateways with Fintechee

Importance of Licenses for Forex BrokersRegulatory compliance is a cornerstone of any legitimate Forex brokerage. Obtaining the proper licenses not only ensures that brokers operate legally but also builds trust with clients and liquidity providers. Brokers without proper licensing risk fines, operational interruptions, and reputational damage. Fintechee understands these challenges and provides structured solutions to

-

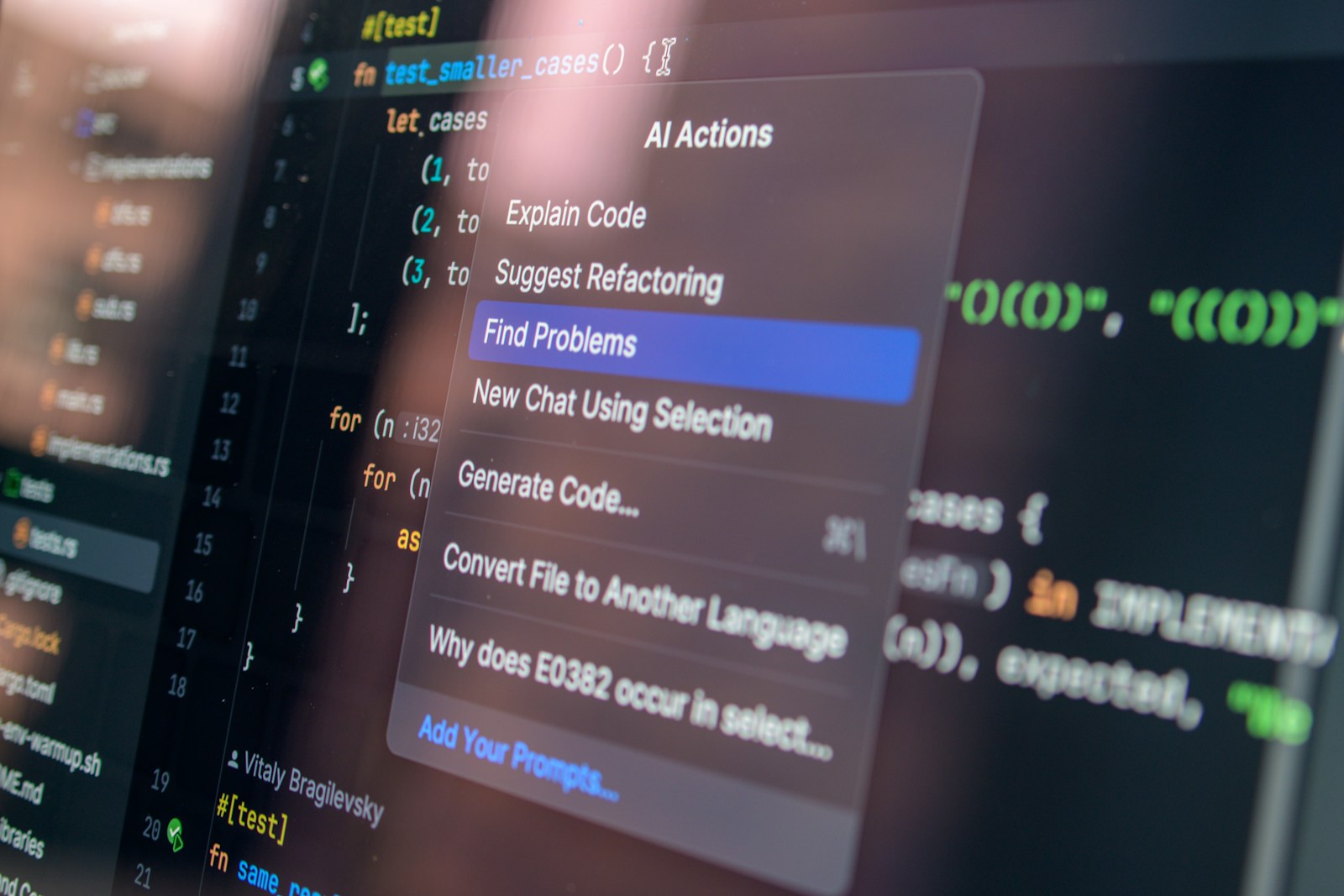

Real-Time Risk Monitoring and Control Using FiSDK

In modern trading environments, risk monitoring and control are critical for ensuring platform stability and protecting both traders and administrators from unexpected losses. With volatile markets and high-frequency operations, delays in detecting risk exposure can lead to significant financial consequences. FiSDK provides the tools needed to monitor positions, manage risk, and respond to critical events

-

Why Forex CRM Requires Extreme Automation

The Forex and CFD industry operates at a scale and speed that traditional CRM systems were never designed to handle. Brokers must manage thousands — or even millions — of client interactions, real-time trading events, regulatory requirements, and operational workflows simultaneously. Manual processes introduce latency, inconsistency, and risk. In high-volatility market conditions, even small delays

-

Token-Free Copy Trading: A Safer Architecture for Brokers and Traders

As copy trading ecosystems grow more complex, security has become one of the most critical concerns for brokers and traders alike. Many traditional copy trading solutions rely heavily on third-party services and token-based authorization models. While these approaches enable integration, they also introduce significant security and operational risks. Fintechee takes a different path by offering

-

Real-Time Trading with FIX API Gateway

In modern financial markets, milliseconds matter. Real-time trading demands not only fast execution but also immediate feedback and full transparency. The FIX protocol has long been the industry standard for achieving this, and Fintechee’s FIX API Gateway takes real-time trading to the next level by combining speed, reliability, and deep backend integration. Key FIX API

-

Seamless Migration from Legacy Trading Systems to the Web

Many trading businesses rely on years—sometimes decades—of accumulated code written for legacy platforms. Expert Advisors, custom indicators, and execution logic built in MQL, C, or C++ often represent a significant intellectual and financial investment. Yet as markets and technology evolve, these legacy trading systems face growing limitations. Fintechee addresses this challenge by enabling a seamless

-

Introducing Broker Mode: Monetization Without a Brokerage License

In the financial trading industry, many participants possess strong marketing capabilities, client networks, and market knowledge, yet lack the regulatory licenses required to operate a brokerage. This creates a significant barrier to entry. Fintechee addresses this gap through its Introducing Broker (IB) mode, enabling monetization opportunities without the need for a brokerage license. Challenges for

Recent Posts

- Multi-Chart Management in Fintechee WEB Trader for Algorithmic Trading

- Why Spread Betting Appeals to CFD Traders in Certain Markets

- Integration of Semi-Decentralized Exchange in Fintechee White Label

- Integrating Third-Party Licenses and Payment Gateways with Fintechee

- Real-Time Risk Monitoring and Control Using FiSDK

Tags

ai-trader automated trading backend supervision blockchain payment broker onboarding broker security broker setup C++ trading strategies CFD alternatives compliance compliance-friendly digital asset transfer EA migration ExecutionReport Fintechee Fintechee FIX API Gateway Fintechee multiple charts Fintechee plugin global market monitoring introducing broker legacy trading systems leveraged trading markets marketing resources MQL migration NewOrderSingle payment gateway integration real-time positions real-time trading regulatory license risk monitoring seamless integration secure copy trading semi-decentralized exchange shared trading environment spread betting traders third-party risk reduction token-free trading trade execution trading infrastructure trading platform trading risk control transparency web-trader WebAssembly trading white label solution